Indus’s real estate advisory practice is established by professionals within the consulting and real estate industry in India, the U.S. & Australia. Indus offers a complete range of development & asset management solutions across the commercial, retail and residential real estate sectors.

We provide independent advice to investors, developers and institutions enabling them to make informed decisions in order to maximise returns and assets values. Our team has worked across the Asia Pacific in development and operations across property classes.

The Indus team includes experts from every stage of the real estate cycle, people with proven track records drawn from best in class international and domestic organizations. This provides Indus with the capacity to deliver complex real estate projects which challenge existing norms and create long term asset value for its clients. Indus typically works with clients across the life cycle of a project from design, consultant selection, and development management to launch and operation

Indus is dedicated to developing investment grade real estate projects in India and managing these through the asset cycle. Indus brings a structured approach to developing and delivering real estate projects from land identification and inception design, construction, financing, marketing, final occupation and ongoing asset management.

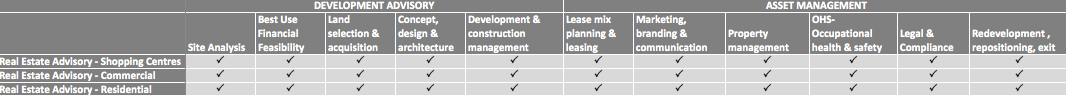

Service offerings & domains

Retail Asset Management

Retail Asset management refers to the full spectrum development and management of a shopping centre across the complete life cycle of the asset.

The entire focus of Indus’s retail asset management strategy is to improve the customer experience (and therefore share-of-wallet) of its assets under management and create a brand around the asset that ensures a loyal and sticky customer set into the future. This competitive advantage leads to higher footfalls, conversions and trading density and ultimately, a higher asset valuation.

The following stages typically comprise the retail asset management process:

- Site analysis

- Best use financial feasibility

- City & Micro-market Location Analysis

- Multi-sector Analysis

- Development Impact Analysis

- Multi-option financial Analysis

- Risk-value assessment Analysis for optimum development mix

- Land selection and acquisition

- Concept and architecture

- Construction management

- Lease mix planning

- Marketing, branding and communication

- Leasing

- Property and Facilities management (retail/ commercial)

- Occupational Health & Safety (OHS)

- Redevelopment & repositioning

- Legal & Compliance

Development Advisory

Indus Asset Advisers caters to the needs of developers, landowners, investors and financial institutions by providing development advice, valuation, design and construction advice and execution, marketing strategies, transaction and management services.

Indus provides full service property development services in India through an internationally proven and recognized team delivering world class real estate solutions across SEZ, Business Park, retail, hospitality, leisure and residential sectors.

- Consulting

- Project Management

- Project Marketing

- Property Management

Leasing Advisory

Asset Leasing is a core competence of the Indus team. A typical lease cycle includes the following key stages:

- Trade area assessment & Competition Analysis

- Product positioning

- Consumer Research completed & inferences drawn

- Category Mix

- Retail tenancy Mix & Centre merchandising

- Retail component Zoning

- Performa development

- Customer & vehicular circulation

- Space Optimization

- Sight lines & Visibility Signage policy and procedure

- Visual display

- License Contract drafting and signoff

- Coordinating Fit out Hand-over

- Getting the Design Criteria in place

- Coordinating the Hand over

- Trade commencement

- Stabilization Manoeuvres, Monitoring & Review

- Rightsizing & Store optimization

Commercial & Residential Asset Management

- Site analysis

- Best use financial feasibility

- City & Micro-market Location Analysis

- Multi-sector Analysis

- Development Impact Analysis

- Multi-option financial Analysis

- Risk-value assessment Analysis for optimum development mix

- Land selection and acquisition

- Concept and architecture

- Construction management

- Sales / leasing

- Property and Facilities management (retail/ commercial)

- Occupational Health & Safety (OHS)

- Redevelopment & repositioning

- Legal & Compliance

Capital Markets-Investments & Structured Finance

The Indus team brings in a combination of in-depth market knowledge, real estate industry experience and financial structuring skills to offer a range of specialized real estate investment banking services. By offering these services, we provide innovative solutions to clients interested in real estate investments, unlocking value from real estate assets through structured sales, joint venture arrangements and leveraged deals (debt).

Investors and owners benefit from the team’s experience and exposure in real estate transactions in the Indian context. Reliable and detailed financial engineering analyses support our valuations, transaction structures and negotiations to create effective and viable solutions around complex transactions.

The gamut of services typically provided as a part of an investment transaction range from financial structuring of the deal to evaluation of the project structure, presentation to potential partners/ investors through preparation of an ‘Information memorandum’ and managing the bid process/negotiating with potential partners in order to attain deal closure.

Range of Services

- Equity and Debt Placement – in income-generating real estate assets that are transacted on a yield basis, including securitization and sale & leasebacks

- Structured Finance – facilitating equity/debt into development projects on behalf of private and government sector clients. This includes structuring Development Financing, Public – Private Partnerships, Joint Ventures and Portfolio Transactions

- Disposal/ Privatization Exercises – includes representation of both buyers and sellers in the strategic sale of private/ state owned real estate/ enterprises